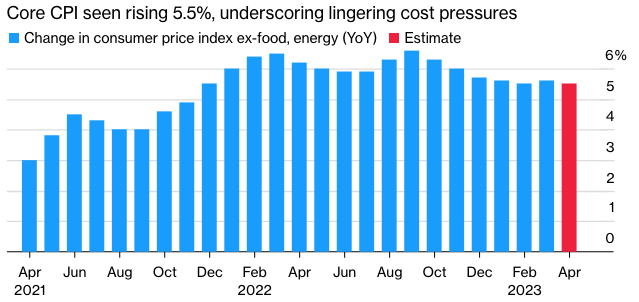

Week Ahead: Key Inflation Report Due

This should offer guidance on whether the Fed will continue raising rates or take a break.

Key takeaways:

- US Inflation date is to be released on Wednesday, May 10th at 8:30 AM ET.

- The report is significant to the future decisions of the Fed on further hiking interest rates.

- CPI is anticipated to be 5.5% for April 2023.

What’s happening:

Next week's release of US inflation data will provide insight into whether the Federal Reserve can pause its series of interest-rate hikes at next month's meeting. The core consumer price index, which excludes food and energy, is expected to have increased by 5.5% in April from a year ago, indicating persistent inflation. The release on Wednesday will be the first of two CPI reports available to Fed policymakers before their June rate decision. Additionally, data on producer prices will be released on Thursday, and economists anticipate an increase in cost pressures for April compared to the previous month.

On May 3rd, US central bankers increased their benchmark interest rate by a quarter point, as anticipated, but hinted at the possibility of pausing the most aggressive tightening campaign since the 1980s. While the Fed's efforts to curb inflation have been gradual, they must also take into account recent difficulties at regional banks and the cumulative effect of their year-long hiking campaign on the economy, where rate hikes have a delayed impact.

Our take:

Next week's US inflation data is expected to show a 5.5% increase in core CPI from April last year, highlighting persistent inflation. This data will add to the Fed's challenge of balancing various economic factors, including the strong labor market, pressure on regional banks due to a mismatch between low-yielding assets and rapidly increasing liabilities, and the potential for high inflation rates to become ingrained in consumer behavior, leading to a vicious cycle of future inflation expectations.