What does the Mortgage Fee Change Mean for You?

Are there really higher fees for higher credit score?

Key Takeaways:

- The Federal Housing Finance Agency has created a new rule effective May 1, 2023, which adjusts mortgage fees depending on the homeowner's credit score. Those with good credit scores will have slightly higher fees, while those with lower scores will get slightly lower fees.

- Higher credit score homebuyers will still have lower overall fees; these balances fees out across the spectrum of credit score borrowers.

- The rule aims to encourage more first-time and low-income homebuyers to own homes.

What is happening: The Federal Housing Finance Agency (FHFA) is implementing changes to mortgage fees on conventional loans backed by Fannie Mae and Freddie Mac. The fees, called loan-level price adjustments (LLPAs), are based on factors such as credit score and down payment. FHFA says the changes are part of its broader goal to create a more resilient housing finance system and ensure equitable mortgage access for more homebuyers. The changes based on credit score are effective for loans securitized before May 1, 2023, and do not impact mortgages insured or guaranteed by other agencies.

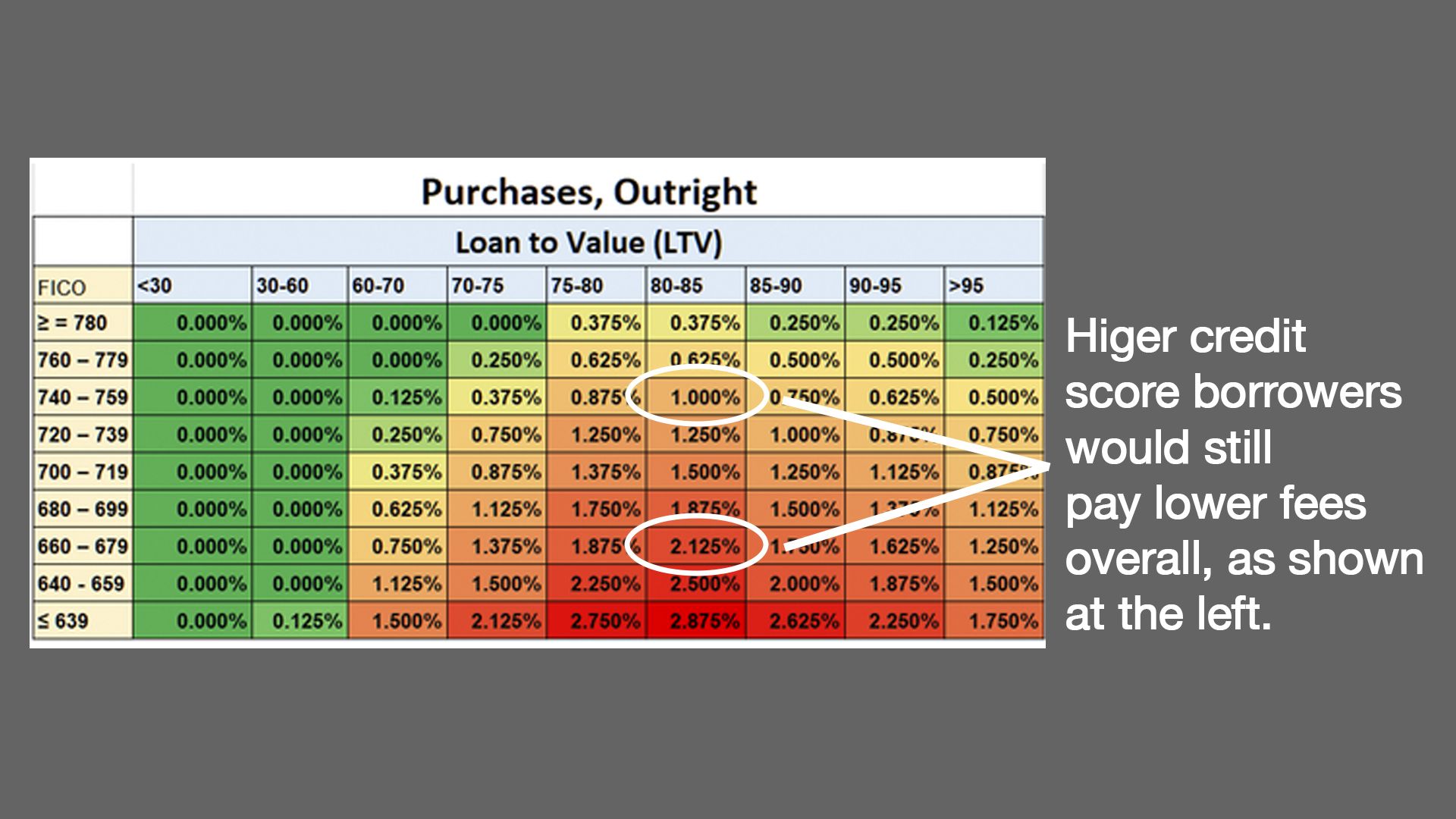

There has been significant confusion on this issue, not only from homebuyers but also from the financial press. Many headlines confuse the change in fees with the actual cost of the fees. Below is a chart from Mortgage News Daily, which demonstrates that the actual cost to higher credit score borrowers is still lower than the cost to lower credit score borrowers.

Under the new federal rule, many homebuyers with higher credit scores who make down payments between 5 and 30% will see their fees increase compared to the current rates. People with lower credit scores will generally see their fees decrease, regardless of the size of their down payment. However, FHFA says the updated fees do not represent pure decreases for high-risk borrowers or pure increases for low-risk borrowers. Mortgage lenders often factor LLPAs into a borrower’s interest rate for their mortgage loan rather than charging them a direct fee. Borrowers who make a down payment of less than 20% will still have the added cost of private mortgage insurance (PMI).

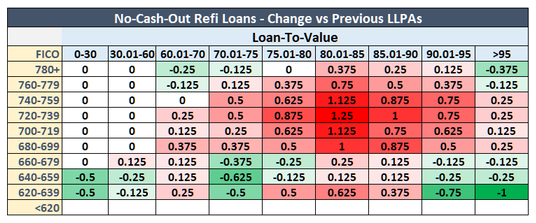

The overall fee adjustment is demonstrated by the chart below from Mortgage News Daily. This chart shows the relative re-balancing of the fees, shifting some higher fees on high credit score borrowers and reducing some fees on the lower credit score borrowers.

Our take: While initial reports framed this as increasing the total cost for higher credit borrowers, the re-balancing of the fee structure seems to be driven by new studies that show that lower credit score borrowers are not necessarily as high a risk as the fee structure would imply. This balancing attempts to reduce the burden on lower-income and first-time buyers in line with this updated credit assessment.